TARIFFS IMPACT INCONSISTENT ACCROSS HEALTH AND WELLNESS SECTOR

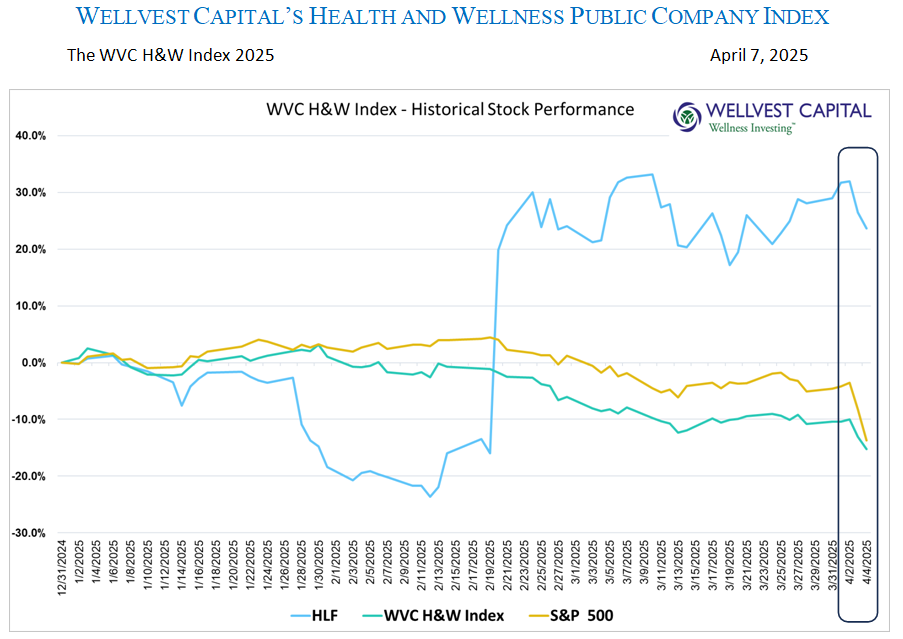

President Trump’s tariff announcement on Wednesday April 2, 2025, shocked financial markets driving down stocks across the board by more than 10% over two trading days. The Wellvest H&W Index was pushed down to a loss of 15.23% YTD as of the close on April 4, 2025. Recent news articles and Daniel Fabricant, PhD, President and CEO of the Natural Products Association (NPA) report that the nutrition category could be spared from the full brunt of tariffs. The White House’s products exempt from tariffs list includes certain vitamins, amino acids, CoQ10, minerals and select supplement ingredients. While these exemptions are only a sub-set of the supplement category and the broader health and wellness industry, it is promising to have some relief.

HIGHLIGHTS

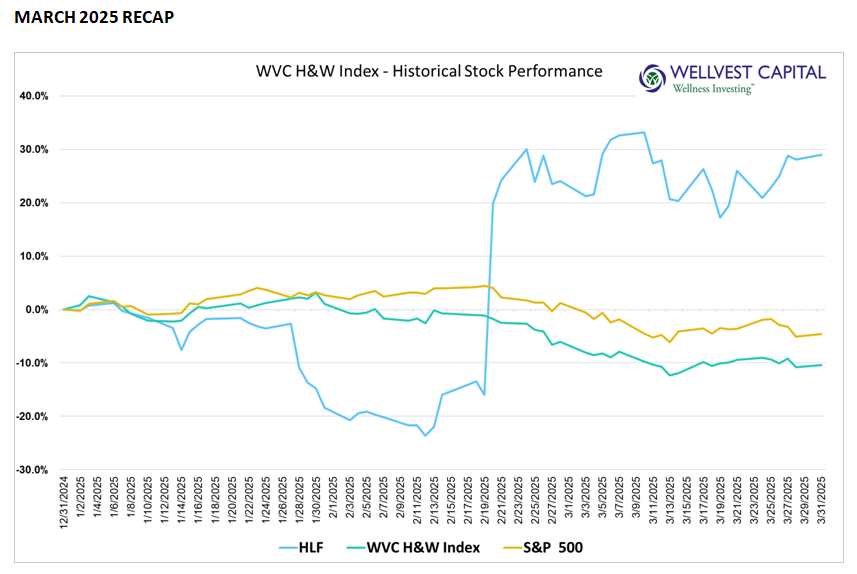

The month of March has been long and painful for the stock market. The S&P 500 was down 5.75% for the month, bringing the benchmark YTD return to a negative 4.59%, excluding dividends. The Wellvest H&W Index narrowly beat the S&P to end the month down 4.69% and 10.42% YTD. Edgy investors kept the selling pressure on especially in the tech sector, with the NASDAQ giving up 10.4% YTD. The rapid-fire global news cycle of every changing tariffs, inflation, interest rate speculation, cease-fires, and good old fashion earnings reports have created an unbearable level of uncertainty; sell first, ask questions later.

The macro themes are overwhelming just about everything else. Until many of these are sorted out, the selling trend may continue. The WVC H&W Index is heavily weighted toward food and consumer goods many of which use imported ingredients, tariffs will negatively impact these companies. While it’s much too early to call a bottom, starting a target buy list never hurts.

NOT LOST IN THE SHUFFLE

Mr. Market is still rewarding strong performance. Herbalife Nutrition (HLF) printed earnings above expectation and was rewarded with a nice pop in the stock back in February. The stock has managed to maintain its bid in March. HLF is up 29.00% YTD making it the second-best performer in the WVC H&W Index behind investor favorite Celsius Holdings (CELH). Celsius was up 38.7% in March and 35.2% YTD on positive earnings and outlook. The rest of the bunch in the H&W Index did not fair as well. The average 2025 increase of 13.8% for the 14 gainers was no match for the 34 losers, which averaged 20.4% loss YTD. While it’s comforting to see that strong earnings are recognized and rewarded with price appreciation the industry backdrop of FDA regulatory changes in policy, rulemaking, and staff levels will continue to be a strong headwind for the sector.

H&W INDEX WINNERS and LOSERS – YTD as of March 31, 2025

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025