HIGHLIGHTS

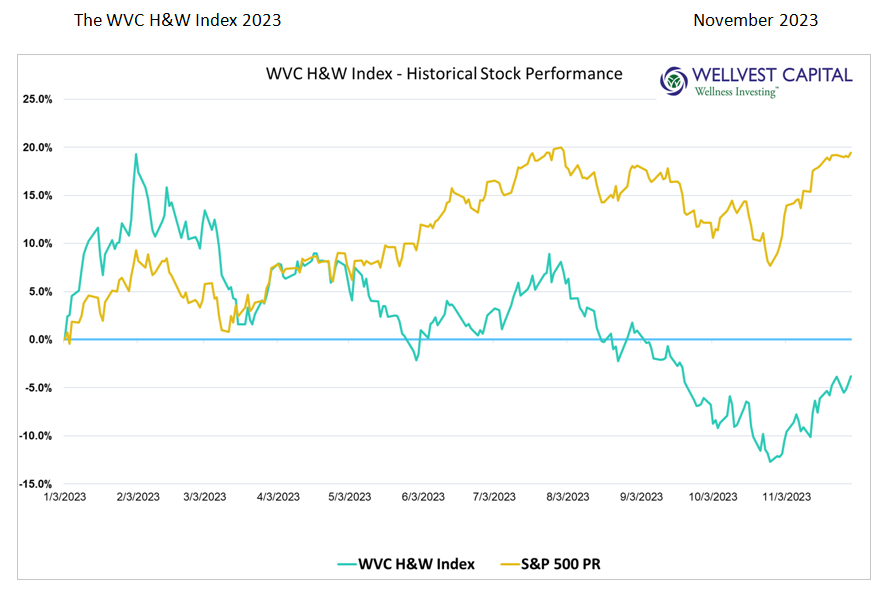

The macro narrative around interest rates, inflation, employment, and geo-political concerns pivoted to fuel a strong market rally in November. The downward trend that started in August reversed course generating an 8.9% increase to the S&P500 for the month leaving the index up 19.5% year to date, excluding dividends. The WVC H&W Index held its own against the S&P500, increasing 8.6% for the month, bringing the YTD performance to a negative 3.8%, excluding dividends. The big drop in yields on the 10-year Treasury Bond from about 5.0% to 4.3% at month end was a predominate driver.

For The WVC H&W Index, the big question now is, “was November just a ‘Dead Cat Bounce’ or the start of a sustainable rally?”. Many of this year’s biggest losers including Oatley, Honest Company, Peloton, and Beyond Meat had large upside moves for the month, ranging from about 20% to 100%+. The near-death experience for some of these innovators may be the catalyst needed to course correct for growth and profitability.

THE WINNERS and THE WINNERS

In sports the final score does not always tell the real story, same for the stock market. The WVC H&W Index this month had numerous winners, for some this was the acceleration of historical strong performance, for others it was a reversal from a dismal year. The top performers all have strong brand awareness and well-run businesses. Lifeway Foods (LWAY) kept right on trucking adding to its exceptional 2023 with a 31.1% jump in November, and 152.1% YTD. BellRing Brands (BRBR) increased shareholder value with 21.0% share price increase for the month bringing the YTD increase to 106.3%. Natural Grocers (NGVC) had a great month, up 24.8%, increasing the YTD return to 71.7%. The proverbial “dead cat bounce” bucket included some familiar names, such as Peloton (PTON), Oatly (OTLY), The Honest Company (HNST) and Jamieson Vitamins (TSE:JWEL). As a group they were up a blistering 61.4% for the month. Even with this exceptional gain the sub-set is down nearly 30% YTD. Only time will tell if this is a value trap or the start of something real for these laggards.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- Thorne Research (THRN)* 181.0%

- Lifeway Foods (LWAY) 152.1

- BellRing Brands (BRBR) 106.3

- WW International (WW) 86.8

- Natural Grocers (NGVC) 71.7

- Top Five Losers

- Smart of Life (SMFL) -93.1%

- RiceBran Technologies (RIBT) -75.7

- United Natural Foods (UNFI) -62.4

- Nautilus (BFX) -59.8

- Nu Skin (NUS) -59.6

Data sources: Pitchbook, Y Charts

Copyright: Wellvest Capital 2023

*Taken private Oct 2023 by L Catterton