HIGHLIGHTS

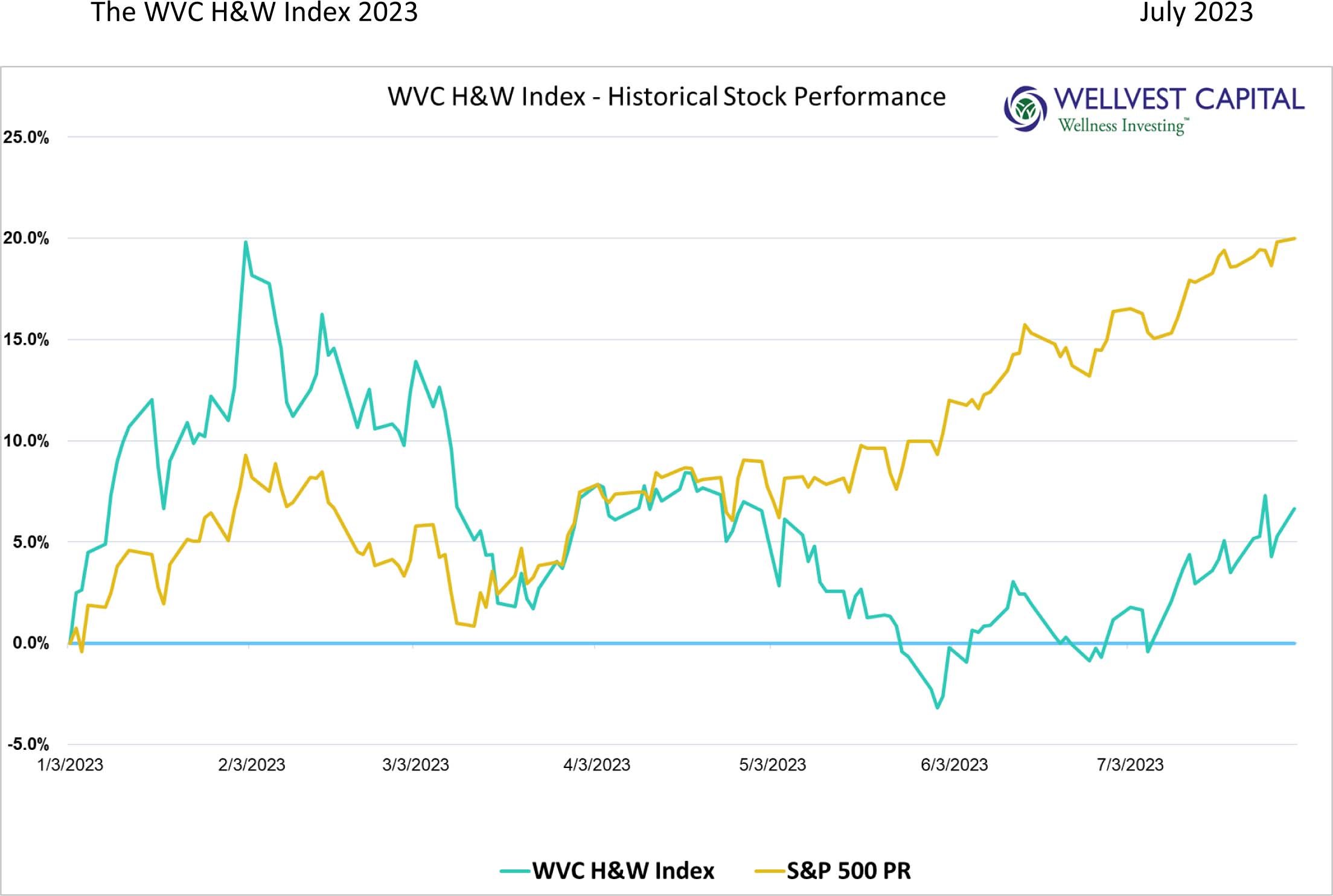

The WVC H&W Index gained ground in July relative to the S&P500. The WVC H&W Index returned 5.48% for the month, raising the YTD performance to 6.64%, excluding dividends. The S&P500 gained 3.11% in July rounding out the YTD gain of 20.0% for the period ending July 31, 2023. The rally in the stock market continued to widen with the small caps once again outperforming large caps as reflected in the Russell 2000 gain of 6.12% for the month.

While the YTD performance gap between the WVC H&W Index and the S&P500 is still substantial it is promising to see the gap starting to narrow. Investors in the health and wellness sector should actively seek opportunities. As the AI narrative starts to fade and sector/capitalization rotation begins to over index, the performance gap may continue to tighten.

BEWARE THE DREADED REVERSE STOCK SPLIT

Stock splits, both forward and reverse, are an interesting paradox in the stock market. The mathematical impact of stock splits is no different than getting change for a $20 bill and receiving a $10 and two $5’s; you still have $20. But the stock market rarely sees it this way, especially for reverse stock splits. Reverse stock splits are when a company retires old shares and gives out new shares in a ratio that gives holders less shares than they had, however assuming a simultaneous increase in price the transaction is a wash, the value of the total holdings stays the same. Reverse splits are typically done to increase the per share price to avoid delisting and make the stock available to institutional investors that cannot invest in stocks under a certain price, often $5 per share. Investors view reverse splits as a negative event with stock prices very often going down. This year, the WVC H&W Index had two companies declare reverse stock splits. Blue Apron (APRN) had a 12:1 reverse split on June 8th and Smart for Life (SMFL) had a 50:1 reverse split on April 24th. Both stocks continued to decline, with APRN down 14.4% since the split, down 45.9% YTD. SMFL is down 86.0% since the split and down 94.2% YTD.

Given that a fair number of publicly traded health and wellness companies are micro and small caps, pay close attention to the absolute value of the stock price. Stocks priced below $5 per share for an extended period could be at risk of delisting and/or a reverse stock split. The WVC H&W Index has seven constituents that trade under $5 per share. As a group they are down 3.4% for the year on an equal-weighted basis, but there is a wide gap between the winners and losers. For the winners Laird Superfood (LSF) at $1.22 per share is up 45.2% YTD, followed by Else Nutrition Holdings (TSX: BABY) at $0.50 per share up 22.7% YTD, with RiceBran Technologies (RIBT) up 21.6% closing at $0.90 per share on July 31, 2023. The losers include The Honest Company (HNST) down 49.5%, Zevia (ZVIA) negative 32.0%, Nautilus (NLS) lost 23.5% and Oatly (OTLY) down 8.6%.

FOCUS ON GLOBAL COMPANIES

The WVC H&W Index has eight stocks that trade on international exchanges outside of North America. As a group these have outperformed the index, gaining 12.0% YTD. This is a diversified bunch including bike companies Giant (TAI: 9921 up 13.2% YTD) and Shimano (TKS: 7309 down 2.7% YTD). Large cap food and beverage players Kerry (LON: KYGA), DSM Firmenich (AMS: DSFIR) and Nestle (SWX: NESN) returned 7.6%, -2.0%, and 5.9% respectively. Rounding out this sub-set is fitness center operator Basic-Fir (AMS: BFIT) up 29.9% YTD and Blackmores (27.1% YTD) which went private earlier this year. Difficult to pinpoint one defining theme, but the lower valuations of international markets relative to the US is providing a tail wind.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- WW International (WW) 201.6%

- Natural Health Trends (NHTC) 69.7

- Thorne Research (THRN) 64.5

- Laird Superfood (LSF) 45.2

- BellRing Brands (BRBR) 40.2

- Top Five Losers

- Smart of Life (SMFL) -94.2%

- Honest Company (HNST) -49.5

- United Natural Foods (UNFI) -46.3

- Blue Apron (APRN) -45.9

- Zevia (ZVIA) -32.0