HIGHLIGHTS

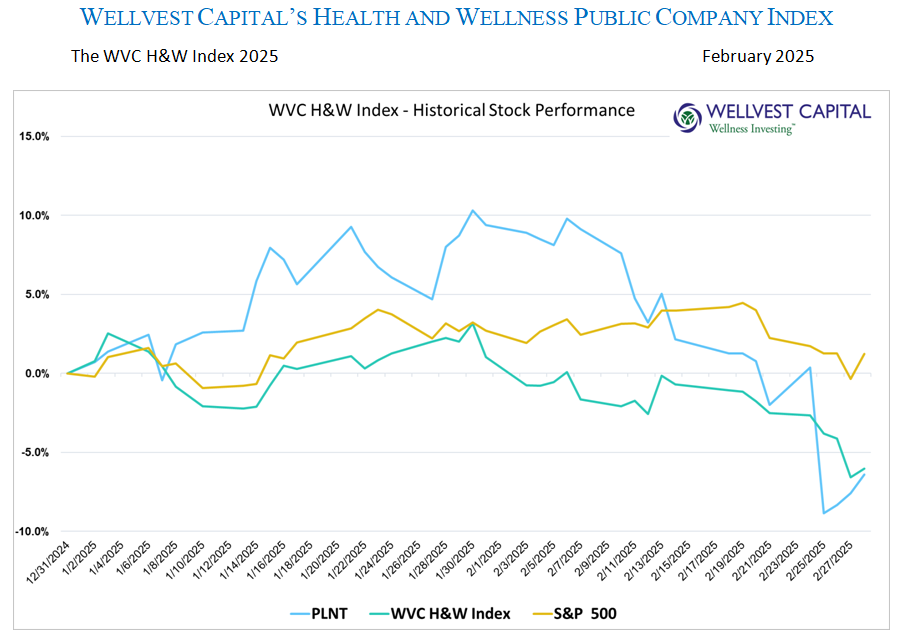

Announcements from The White House and earnings kept investors on edge during the shortest month of the year. The intense news cycle and earnings surprises raised the VIX from about 16 to just under 20 at month end. The SP500 lost ground, dropping 1.42% for the month, reducing the YTD gain to 1.24%, excluding dividends. The old street adage “buy the rumor, sell on the news”, once again rang true. On the heels of Robert Kennedy confirmation, the Wellvest H&W Index lost 6.94% for the month bringing the YTD total to negative 6.04%. The Trump rally for the H&W sector has now faded.

The health and wellness sector is heavily weighted toward food and consumer goods many of which use imported ingredients. Pending tariffs will take their toll on margins and unit volumes as price increases are likely to be met with stiff resistance from overburdened consumers. While the backdrop is bullish for H&W stocks, the headwinds of inflation, either perceived or real, maybe too much for these stocks to overcome in the near term.

PROFIT TAKING

The strong performance in January was subjected to profit taking in February. Gym owner, Xponential Fitness (XPOF) had popped 24.4% in January only to give it all up in February, ending down 1.8% YTD. Vital Farms (VITL), which had added 16.4% early in the year, reversed course ending down 12.2% YTD. On the winning side Beachbody (BODI) extended its gains, up 28.0% YTD, Sprouts Famers Market (SFM) held on to most of the early year increase, closing up 16.7% YTD. Unfortunately, the winners were outnumbered, with 29 out of 48 stocks in the Wellvest H&W Index down for the year.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025