HIGHLIGHTS

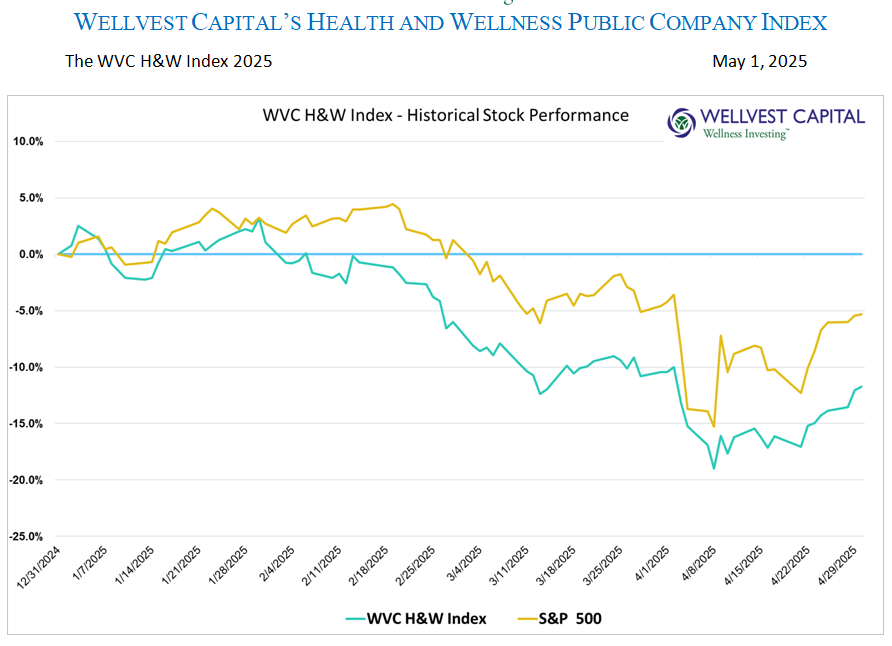

Since the bottom put in on April 21st, the S&P500 has rebounded from a YTD -12.30 to a YTD -5.31 as of April 30, 2025. An impressive rally after what felt like a near death experience given the massive jump in yields at the time. While not as volatile, the Wellvest H&W Index was swept up in the same action, ending the month with a YTD decrease of -11.75%. Outside of gyms and fitness centers, nearly all of the companies in the WVC H&W Index produce tangible goods which directly or indirectly are impacted by tariffs, inflation, and supply chain shocks. The market has clearly acknowledged this as witnessed in the weak price action for the sector.

Companies in the Health and Wellness sector adopted quickly during the Pandemic to rework supply chains, distribution channels and pricing. While many of these lessons learned can be brought to bear in today’s environment, the wild card will be consumer demand across all sectors. Prior to tariffs, cracks in demand, especially on the low end, were already appearing. If the downturn sprouts into a full-blown recession the stock chart above may continue to slide.

CONTRIBUTORS

The YTD -11.75% return for the WVC H&W Index is nothing to write home about on a relative or absolute basis. But it could have been a lot worse. The index was “saved” by about a dozen winners that offset the dismal performance of the rest. These winners have gained 14.86% YTD as compared to the 33 losers, down 23.84% as a group on an equally weighted basis. Too many stocks to list are down over 30% for the year, a sample includes BeyondMeat (BYND) -34.0%, BeachBody (BODI) – 39.0%, Natural Alternatives International (NAII) -30.4%, and Treehouse Foods (THS) -33.7%. The bottom of this notorious pile is listed below. Handicapping what will come next is impossible but could range from a protracted recession to a mild-dip over a few quarters. What is certain is, just like the Pandemic, we will never go back to the way things were; it’s a new path from here on out.

H&W INDEX WINNERS and LOSERS – YTD as of April 30, 2025

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025