January 31, 2022

Profitability Dominates Unprofitable Innovation and Growth

PENDULUM SWINGS WIDE

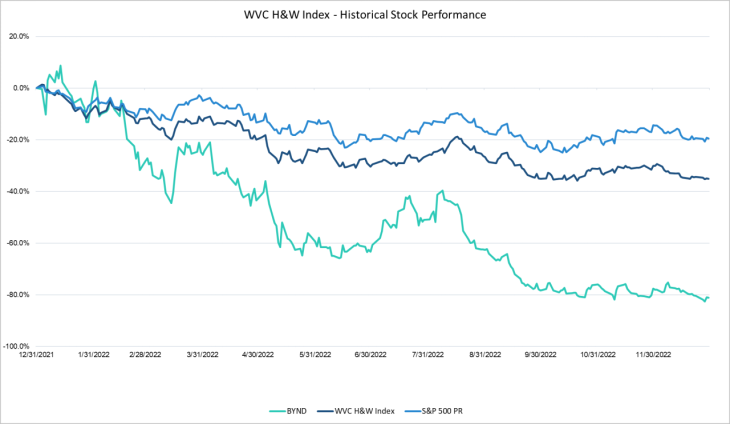

There is no sugarcoating the unhealthy 2022 stock performance of the WVC H&W Index. For the year the index was down 35.06% (excluding dividends) as compared to the S&P 500 price return of negative 19.44%, underperforming the S&P 500 by a whopping 15.62%. A deep dive into the WVC H&W Index components reveals interesting, but not surprising trends. Profitability, as defined by EBITDA margin, was the leading indicator of stock performance in 2022. The handful of companies with superior EBITDA margins, above 20%, significantly outperformed their peers in the index as well as the S&P 500.

This elite group of six companies, out of 44, returned negative 11.48% before dividends, crushing both the WVC H&W Index and S&P 500 by about 23% and 8% respectively. These relative winners include Basic-Fit, Cal-Maine Foods, Darling Ingredients, Lululemon and Planet Fitness. Running behind the elite six were the companies in the WVC H&W Index which had some level of positive EBITDA for the year. This group of 24 stocks returned negative 21.58% before dividends, on an equal weighted basis. Staying on trend, about a dozen companies posted negative EBITDA and generated miserable stock returns of negative 66.09% as a group on an equal weighted basis. The headline news on many in this bottom group has been widely reported, including Oatly, Beyond Meat, and Blue Apron. In general, the durability and viability of their business models have been called into question.

The herd mentality on Wall Street can cause market extremes and anomalies. In 2022 the relative outperformance of highly profitable businesses in the WVC H&W Index may have been impacted by this mentality. These top performers should be viewed with a healthy dose of skepticism. From late 2021 and throughout 2022 inflation dominated decision making for consumer goods companies, retailers, and consumers. For brands and retailers “taking price” was widespread resulting in improved bottom lines for many. Major food and beverage companies like PepsiCo raved about revenue growth coupled with lower unit volumes. Going forward the past benefits to EBITDA margins derived from price increases and cost cutting may wane as consumers and retailers push back on subsequent increases. The investor pendulum could be poised to swing back towards rewarding innovation and growth given the inflation pivot that may be upon us.

THE WINNERS AND LOSERS – A MASH UP

Positive stock market returns where hard to come by in 2022, the WVC H&W Index was no exception. Only six companies in the index delivered a positive return for the year, each had a unique story with no defining trend. Cal-Maine Foods led with a 47.2% return, that isn’t chicken feed! The company benefited from the largest avian-influenza outbreak to ever hit poultry flocks creating scarcity and high profits. SunOpta’s gain of 22.1% in 2022 comes on the heels of a roller coaster ride in 2020 and 2021 driven by all things plant-based and the pandemic. Treehouse Foods benefited from the “take price” dynamic resulting in a very respectable 21.8% gain. Microcap Lifeway Foods delivered with a 20.7% increase. Sprouts Farmers Market had a good year with investors pushing up the stock price by 9.1%; the retailer is an emerging leader in offering better-for-you products to grocery shoppers; squarely in the health and wellness space. And finally, Tivity Health was taken private at a premium mid-year.

In May 2019 Beyond Meat went public to great fanfare and an even greater valuations, by that July it was trading at an all-time high of $234.90 per share. On December 30, 2022, it closed at $12.31. In 2022 the stock was down 81.1%, third in line for the biggest loser award behind Blue Apron, down 87.7% and Laird Superfood down 93.6%. At the time it went public Beyond Meat was the leader in food innovation, a non-meat hamburger that was just like the real thing without the sustainability issues! This kicked off investor’s infatuation with high growth innovation companies in food, beverage, and consumer products with profitability being an afterthought. Culminating in a red-hot IPO market in the first half of 2021 when a number of the companies in the WVC H&W Index became public. From a fundamental perspective these innovators were addressing pent up consumer demand for products that provide solutions to their healthy lifestyles and mission driven values. Investors were prudent to want exposure to this major trend. The over inflated valuations were an indication of the scarcity of public companies in the health and wellness sector and the irrational exuberance often associated with game changing and disruptive innovations.

In late 2021 and 2022 high growth, disruptive, innovative, money losing companies in the health and wellness sector fell to the bottom of the ocean. In some cases, this is where they belong due to poor business models and a growth at any cost approach. However, the core investment thesis regarding health and wellness as a long-term generational shift remains intact. An argument can made that many of the key drivers from 2019 are a higher priority to consumers now. Staying healthy in all its forms is top of mind, climate change and sustainability continue to rise in prominence, social issues and alignment with personal values remain a heavy influence on consumer choices. A host of this year’s loss leaders in the WVC H&W Index align well to this investment thesis, including Oatly, Zevia, The Honest Company, Peloton, and of course Beyond Meat. It will be interesting to see how these companies perform in 2023 and investors’ appetite to embrace them after the beating of the last few years.

RESONABLE VALUATIONS?

It’s no surprise to report that the WVC H&W Index’s Trailing Twelve Month (TTM) PE has come down to 23.0 from its peak of 30.9 in June 2021. The WVC H&W Index, now has a froward twelve-month PE of 24.8. Both the trailing and forward are elevated as compared to the S&P 500 Index’s PE of 19.17 and 20.18 respectively as of September 30th. Alternatively, another valuation metrics points to a lower valuation. The Enterprise Value to EBITDA (EV/EBITDA) for the index is 16.1x on a trailing basis and 12.1x on a forward basis, excluding two extreme outliers. Assuming consumer demand for health and wellness stays on trend, these valuations could be compelling.

Coil the Spring – be prepared

What is the WVC H&W Index telling us? That the health and wellness investment thesis is dead; that innovative, disruptive, high growth companies have broken business models? We don’t think so. It’s impossible to predict what the next 12 months and beyond will hold for these companies in terms of stock performance. But we strongly believe that the health and wellness investment thesis remains intact. The market had a predictable upchucking of overvalued companies that were chasing growth over all other metrics. The market capitulation over the last 12-18 months was necessary to bring a dose of reality to both management teams and investors. For those health and wellness companies that were kicked to the curb in 2022 and have retooled their business models we believe the future looks bright.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

To capture the new health and wellness investment dynamic Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.