HIGHLIGHTS

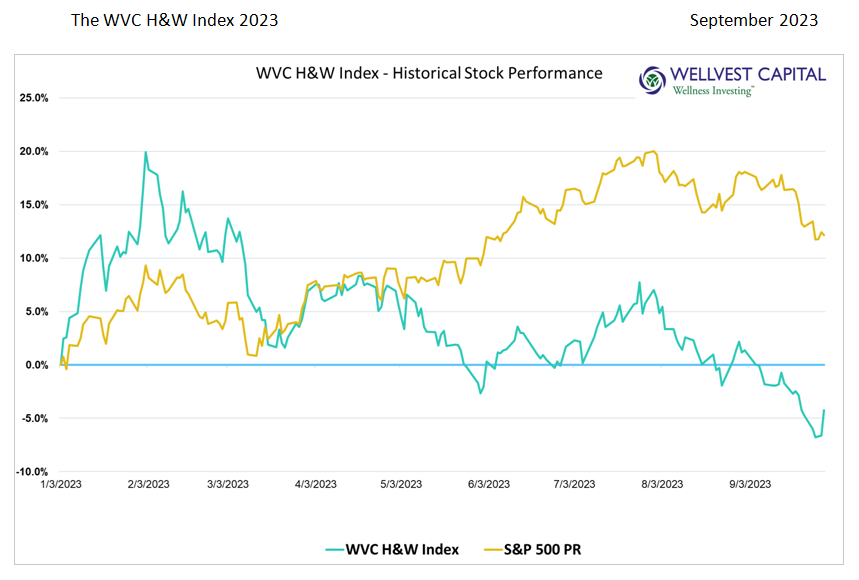

September is living up to its reputation as the worst performing month for the stock market since 1945. This year was no exception with the S&P500 down 4.87% for the month leaving the index up 12.13% year to date, excluding dividends. The WVC H&W Index did even worse than the S&P500, with a negative 5.38% for the month, dropping the YTD performance to a negative 4.26%, excluding dividends. The weakness in the WVC H&W Index was widespread as indicated by a market cap weighted return of negative 5.31% for the month. (As previously noted, the WVC H&W Index is equally weighted due to the prominence of small and mid-cap constituents.)

The heavy bear presence in the overall market and the WVC H&W Index appears to be approaching extreme levels. Over 78% of the names in the WVC H&W Index were down for the month. Given the business model and geographic diversity in the index its difficult to argue that fundamentals drove all these stocks down. Be on the look out for an upside surprise over the next couple of months.

THE HERD IS GETTING SPOOKED

If you have spent any time around horses, cows, or other herd animals you know that when one gets freighted, they all flee together in unison regardless of the perceived danger. The current stock market is exhibiting a similar behavior as indicated by the heavy correlation. The WVC H&W Index has 47 companies, 37 of them were down in the month of September. The average loss for this group was 12.82%. The biggest winner was Blue Apron, up over 49% for the month after a takeover announcement. Even with this impressive performance the stock was severely down from its all-time high. In addition, nine other stocks had a positive return but two of these were takeover targets that are expected to close shortly. From a valuation perspective the health and wellness sector is approaching deep value territory. Average Enterprise Value (EV) to Next Twelve Month (NTM) Revenue is 1.6 with a median of 1.0, with many names well below 1. Another widely followed valuation metric, EV/NTM EBITDA average is 12.0 with a median of 10.6, with a large number of stocks in single digits. It is fascinating to see these public market valuations when compared to private market valuations. Wellvest rarely sees transactions at such low multiples in M&A values for on-trend, profitable health and wellness companies.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- WW International (WW) 186.8%

- Thorne Research (THRN) 180.7

- Lifeway Foods (LWAY) 86.8

- BellRing Brands (BRBR) 60.8

- Natural Health Trends (NHTC) 54.5

- Top Five Losers

- Smart of Life (SMFL) -97.7%

- United Natural Foods (UNFI) -63.5

- Honest Company (HNST) -58.1

- SunOpta (SOY) -59.7

- Chewy (CHWY) -50.8

Data sources: Pitchbook, Y Charts

Copyright: Wellvest Capital 2023