Underperformance Continues as High Growth Falls Out of Favor

“The BIG themes – the pandemic, inflation, labor shortages and supply chain disruptions are unlikely to magically disappear over the next twelve months, with some luck they may diminish in magnitude.” – WVC H&W Index Performance Recap 2021 – January 31, 2022.

Since January the “BIG themes” have gotten bigger, most notably inflation! The only thing that has diminished in magnitude is the pandemic, but its shockwaves are still being felt in the labor market and supply chains. The combined effect is runaway inflation and the Federal Reserve raising interest rates at a pace not seen since Ronald Regan first took office. For financial markets it was the worst start of the year since the very early 1970’s,very little was spared including the WVC H&W Index, but there were a few bright spots underlying the headline news.

STRONG WELLNESS COMPANIES SHINE

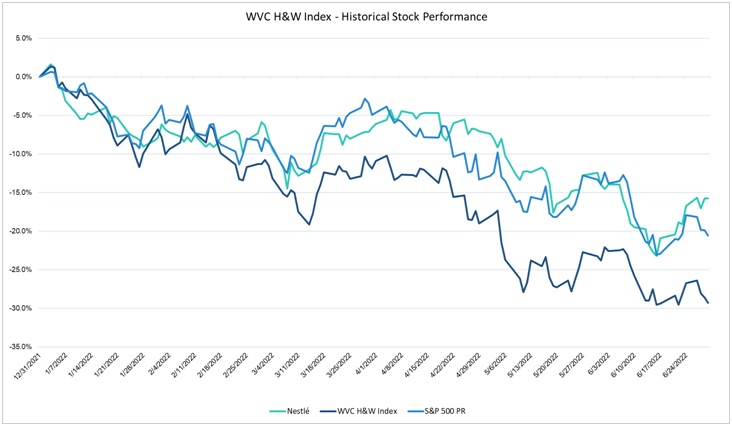

On the surface the WVC H&W Index did not do well during the first half of 2022, the index returned negative 29.3%, underperformed the S&P 500 by about 9%. But like any index, this does not tell the whole story. Out of the 40+ stocks in the WVC H&WIndex, six had positive returns and nearly half beat the S&P 500 index YTD performance of minus 20.58% (excluding dividends).The WVC H&W Index six winners returned 15.3% as a group. A fair number of stocks in the WVC H&W Index beat the S&P 500, 18 in total. These 18 stocks had a negative 3.8% return (on an equal weightedbasis, excluding dividends). This is outstanding relative performance for this sub-group of health and wellness companies. The bulk of these companies are food brands, food distributors, food manufacturers, natural grocery retailers and a few supplement brands.A top performer in this cohort was Tivity Healthwhich was taken private resulting in a 22.9% YTD 2022 return. Health focused legacy food brands, Atkins, Quest (The Simply Good Foods Company), and Lifeway handily beat the S&P 500 Index with returns of minus 9.1% and positive 8.0% respectively. Egg producer Cal-Maine Food was another bright spot cracking into the top spot with a 33.6% gain over the last six month proving once again that when the music stops profitable companies still have a seat.

Offsetting this stellar showing was significant weakness from the majority of the index’s components. Many in this sub-group gave up over 50% of their market value in the first six months of the year. Once high flying, high growth innovators fell back to earth as investors headed for the exits. Missed forecasts, poor earnings and lowered forecasts all transpired to shake investors’ confidence across this sub-group.Large losses drove down Beyond Meat, Blue Apron and Chewy which returned negative 63.3%, 45.9% and 41.1% respectively for the period. Fitness hardware makers Nautilus and Peloton continued to suffer with losses of 71.5% and 74.3% respectfully as the COVID up-tick faded rapidly and rosy forecasts of their TAM’s were revised downward.The health and wellness IPO darlings of 2021 could notreignite investors’ enthusiasm. Oatly, The Honest Company and Thorne Research continued their downward trend with market losses in the range of 22% to 64%. After the drubbing most of these stocks took in late 2021, one mustwonder when this group will catch a bid – perhaps those that are profitable will be first up.

The largest company in the WVC H&W Index, Nestle, is an interesting case study as well as a bellwether food company. In the last many years Nestle has invested heavily in supplements and healthier offerings, including purchasingVital Proteins, The Bountiful Company, Atrium, Persona and Nuun as it works to reinvent itself and align to the global health and wellness trend. It can be argued that the company represents both the old-line legacy “big food” model as well as the more nimble disruptive innovators. The performance of the stock over the last six months reflects this positioning as it closely tracked the S&P 500 and split the difference between the WVC H&W Index top and bottom performers with a six month return of negative 15.8%.It will be interesting to see how this stock performs over the rest of this year and what M&A opportunities could arise.

HEALTH AND WELLNESS RETRENCHMENT

The Health and Wellness sector has been on a steady increase for nearly a decade with a rapid acceleration of consumer acceptance during the pandemic. Private investments made years ago, abundant capital and an extraordinary public market fueled the subsequent hot IPO market resulting in many of companies in the WVC H&W Index being added over the last few years.These new listings and the evolution of legacy players attracted investors attention to this exciting, on-trend sector of the public markets, pushing up valuations. The WVC H&W Index’sTrailing Twelve Month (TTM)PE peaked at 30.9 in June 2021.A year later macro-economic forces have brought valuations back down to earth.The WVC H&W Index now has a below market TTM PE of 17.7 and a froward twelve-month PE of 13.4. Both the trailing and forward are below the S&P 500 Index’s PE of 19.2 and 16.0 respectively as of June 30th. Underlying the overall weakness is investors’spirited rejection of money losing businesses as reflected in the negative 44.4% loss for the 14 names in the WVC H&W Index with negative earnings. It’s likely that the Health and Wellness sector will experience a classic retrenchment as weak business models fall to the wayside and profitable well capitalized companies take market share organically or through select acquisitions.

Coil the Spring – be prepared

Roman philosopher Seneca once said, “Luck is what happens when preparation meets opportunity.” This statement is a calling card for today. From a public market perspective, therepricing in the health and wellness sector will offer tremendous long-term opportunities. The health and wellness trend is now a permanent lifestyle for generations of people from Gen Z to Baby-Boomers. The best business models and management teams will continue to drive long term value creation, while the macro-economic environment offers investors attractive entry points along the way. We will keep you posted!

Please visit Wellvest’s library of insights and articles at www.wellvestcapital.com/newsroom

Data sources: Pitchbook, Yardeni Research, Inc.