HIGHLIGHTS

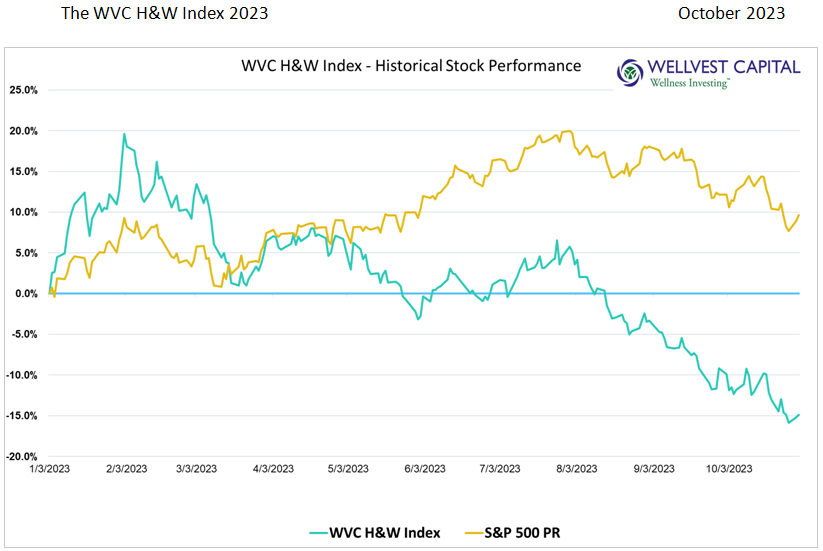

The downward trend that started in August continued in October characterized by a significant underperformance to the S&P500. The S&P500 was down 2.2% for the month leaving the index up 9.7% year to date, excluding dividends. The WVC H&W Index did even worse, with a negative 5.7% for the month, dropping the YTD performance to a negative 14.9%, excluding dividends. The yields on risk free Treasury Bills, Notes and Bonds at about 5% and giving equities a considerable headwind as investors adjust risk appetites.

The more speculative companies in the WVC H&W Index, most of which became public in the last few years are struggling to keep investors’ interest. Many of the leading innovators including Oatley, Honest Company, Peloton, and Beyond Meat are down well over 40% to 70% YTD. Demonstrating that exciting on-trend, heavily marketed products, and services can only go so far if the business model is not sound.

THE SUNNY SPOTS

Jim Cramer famously says, “There’s always a bull market somewhere.” For a select group of companies in the WVC H&W Index this is true. These top performers all have strong brand awareness and well-run businesses. Lifeway Foods (LWAY) had a stellar month adding to its exceptional 2023 with a 2.9% pop in October adding to its 92.3% YTD return. Peer group food brands Danone (PAR:BN) and BellRing Brands (BRBR) both increased shareholder value with 1.7% and 6.1% share price increases for the month bring YTD increases to 7.0% and 70.6%, excluding dividends. Two naturally focused grocers are proving that in-store shopping is not dead. Natural Grocers (NGVC) slipped 2.6% for the month but kept a 37.5% YTD return in the bag. Sprouts Farmers Market (SFM), a strong supporter of emerging food and beverage brands, gave up a little value in October with a loss of 1.8% bringing the YTD increase to 29.8%. The top brand in the athleisure wear category, Lululemon Athletica (LULU), has been rewarded for management’s positive changes resulting in 2.1% and 22.8% stock price increases MTD and YTD. The outstanding relative performance of this group of companies is a pleasant reminder that investment opportunities often emerge during times of stress, uncertainty, and negative sentiment.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- Thorne Research (THRN) 181.0%

- WW International (WW) 102.6

- Lifeway Foods (LWAY) 92.3

- BellRing Brands (BRBR) 70.6

- Natural Health Trends (NHTC) 62.7

- Top Five Losers

- Smart of Life (SMFL) -95.1%

- Oatly (OTLY) -71.8

- United Natural Foods (UNFI) -62.3

- Honest Company (HNST) -61.5

- RiceBran Technologies (RIBT) -56.8

Data sources: Pitchbook, Y Charts

Copyright: Wellvest Capital 2023