November 9, 2021

PAST IS PROLOGUE

The health and wellness movement traces its roots back to the late 1960’s and early 1970’s, it emerged from the counter-culture revolution of the period. The “hippies” were getting back to nature and seeking food and other goods that were natural, healthy, and less establishment. Fast forward 20 years to the late 1980’s and early 1990’s and many of these homegrown products and companies had matured into relatively large and sophisticated organizations. Seeking growth capital and to monetize shareholders investments a handful of these early players went public via IPOs. A very small group of forward-looking investors were early adopters and evangelists of Health and Wellness as an investment thesis with ESG being a natural component.

This generation of public companies included supplement brands, natural products retailers, food and beverage brands and multi-level marketing firms. Companies such as Herbalife, GNC, Vitamin Shoppe, Nature’s Bounty (NBTY), Natural Alternatives International, Weider Nutrition International, USANA, Reliv, and The Hain Celestial Group provided investors with exposure to the rapidly growing health and wellness category. When these companies went public the IPO market was very accommodating to smaller companies with the majority of all IPOs being under $50M prior to 1998. By the late 1990s the IPO dynamics changed rapidly primarily due to regulatory changes. The number of IPOs, especially small deals plummeted into the year 2000 and stayed on the floor, flatlined for nearly two decades. For small innovative emerging health and wellness companies the IPO market effectively shut down until the recent renaissance that started with the landmark Beyond Meat IPO in May 2019.

A new golden age for health and wellness companies is here and public markets are playing an important role. Macro trends of aging baby boomers and the coming-of-age millennials and Gen Z has driven strong demand for better-for-all solutions to nutrition, food, beverage, sustainability, and social impact. These same consumers are now driving the rise in ESG investing. Health and wellness companies have been living this mission since the first hippy planted an organic vegetable garden in the backyard. This perfect storm of intersecting consumer and investment trends have positioned health and wellness in the sweet spot. Mix in a robust IPO market, maturing VC/PE portfolios and the result is a plethora of health and wellness companies going public. Recent pure play IPOs include Oatly, Zevia, The Honest Company, Vital Farms, Peloton, and Laird Superfoods to name just a few.

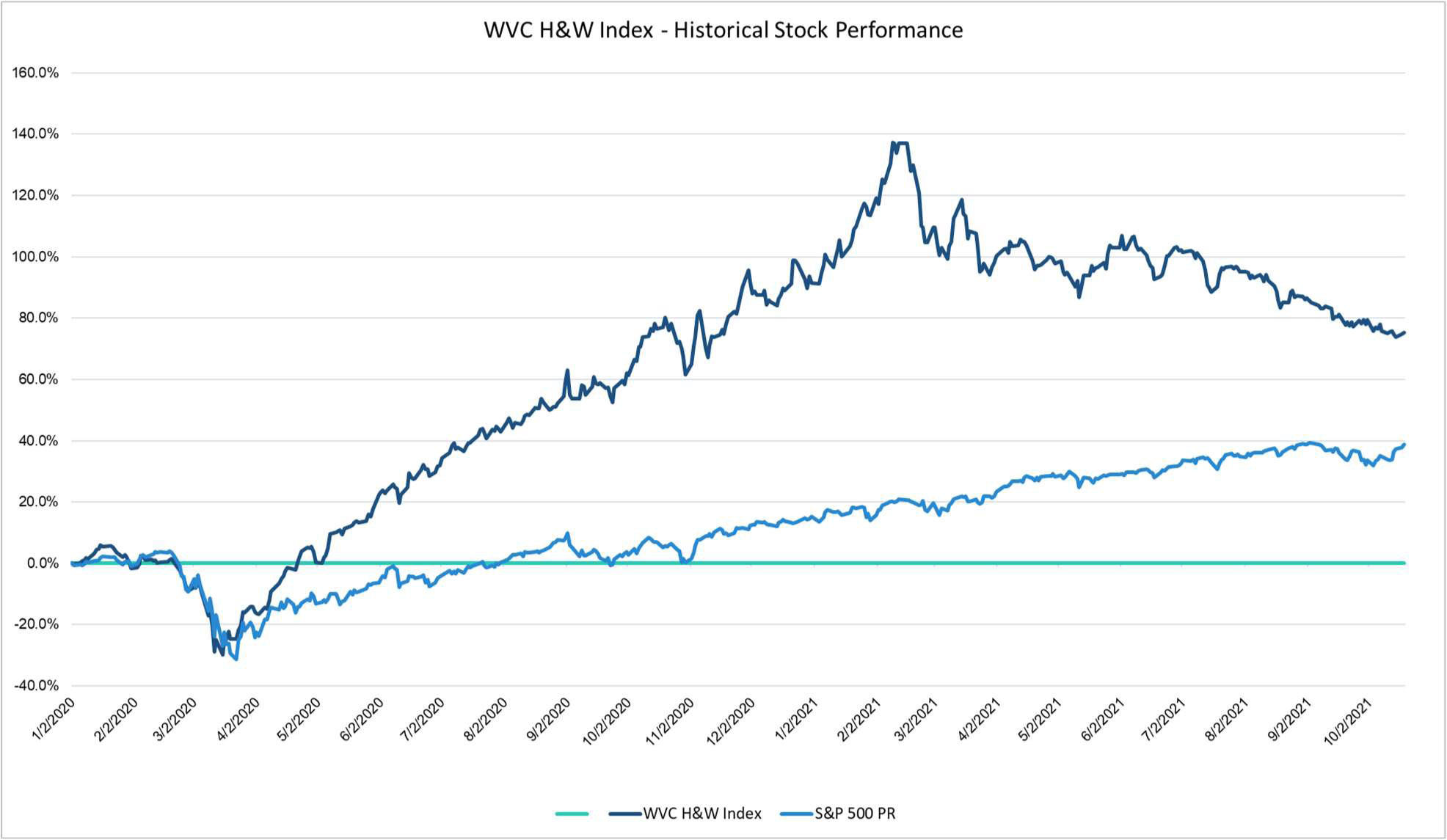

To capture this new investment dynamic Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

WHAT’S AHEAD

This is just the beginning. Health and wellness in all its forms; preventative care, telemedicine, better-for-you foods, functional beverages, integrative medicine, and fitness are here to stay. From a public market perspective, the health and wellness investment thesis is just getting off the ground floor. As the small and mid-cap companies in Wellvest’s Health and Wellness Index grow and mature, liquidity will increase, offering greater investment opportunities. Lululemon began as a niche yoga brand that has crossed over into the mainstream and now has a $50B+ market cap. The steady drumbeat of M&A and private financing will continue to transform legacy companies into more pure plays; consider the transformation of powerhouse brands like Nestle. Nestle has invested heavily in H&W via M&A such as The Bountiful Company (aka NBTY), Vital Proteins and NUUN. How long will it be before plant-based facsimiles of beef, chicken, fish and other animal based protein become common place on every dinner table and restaurant menu? Beyond Meat and Impossible are leading the way with many more peers coming up behind them; private capital is very rapidly being deployed in this category today. It’s only a matter of time before many of these companies are publicly listed. It’s reasonable to believe that three to five years from now public pure plays in plant-based/cultured/alternative proteins will be widespread and a sub-thesis within the overall health and wellness investment sector.

Coil the Spring – be prepared

COVID and public market dynamics has pulled health and wellness investing into the realm of public market investors. Once private companies are now issuing stock to meet the demand of ESG investors as well as other interested market participants. The growth and evolution of health and wellness companies will only enhance, enrich, and expand the opportunities in both the private and public markets. Wellvest believes monitoring the public markets through Wellvest’s Health and Wellness Index will inform private market transactions be they VC, PE or M&A. Public market valuations, trends and dynamics have long provided a key back drop to private markets. Now we are in the beneficial position of having public benchmarks and comps that directly correlate to our growing, essential, and influential industry. Stay tuned!