HIGHLIGHTS

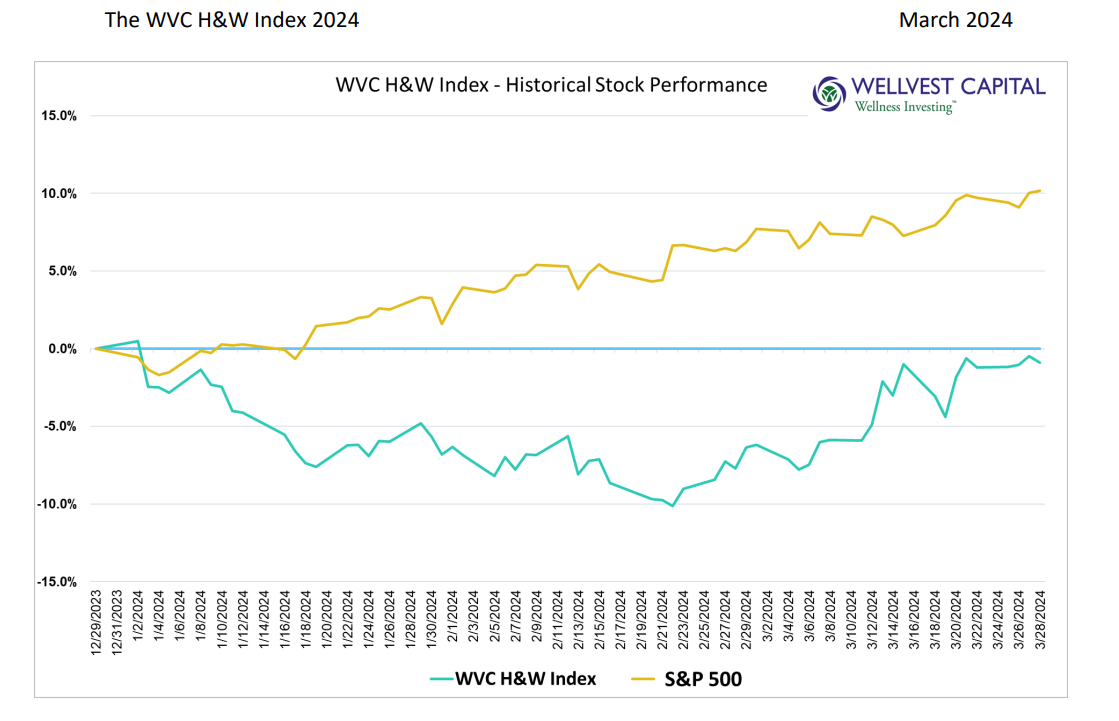

The S&P500 keeps grinding higher with a 3.10% gain for the month bring the YTD return to 10.16%, excluding dividends. The Wellvest H&W Index rebounded smartly for the month, returning 5.45% to bring the YTD loss to 0.91%. The headline news over the last four weeks continued to reinforce the narratives driving the markets; macro stories of inflation, geopolitical uncertainty, and a resilient consumer, along with company level fundamentals. We suspect that in the absence of market moving news, the equity markets will continue on the current trajectory, at least in the short term.

Speaking of fundamentals, in case you missed it, Laird Superfoods (ASE: LSF) has risen from the dead. A few short months ago an astute observer may have added it to the bankruptcy watch list. Fortunately, management has turned the company around. Delivering a profitable Q4, improved margins, and generated positive cash flow.The stock had a big pop on the news and is now up 163.7% YTD.

“TAKING PRICE” NO LONGER AN OPTION

Prior to 2021 the majority of the companies in WVC H&W Index rarely increased prices for fear that major retailers would push back, and on-line consumers would switch brands. As we all know COVID changed all that, igniting inflation and opening the flood gates to routine price increases. In many instances, revenue and earnings growth were achieved by “Taking Price” even when volume was decreasing. This became so prevalent that Big Food and Big Soda didn’t take issue with the loss of unit volume. All indications point to a change in this dynamic. Unit volume is dropping rapidly in many categories and consumers are trading down to cheaper alternatives with Private Label brands seeing strong consumer demand and increased volume. Going forward market participants need to pay close attention to the “demand destruction” story. With price increases off the table and consumers adapting to alternative products, some brands may find it very challenging to win back consumers

and increase unit volumes.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2024